The Evolution of the Chief Financial Officer

The days have passed when the responsibilities of the Financial Director were Accounting, Treasury and Taxes.

Technology has rapidly transformed the role of the CFO and the expectations of this function in the organization. Having access to important data in almost real time, many of the traditional expectations are no longer sufficient. Over the years, with the abundance of available analytical tools, tables and all kinds of graphs, the Chief Financial Officer has the ability to link: strategy and operation.

Uniting the Strategy with Performance: Telling the story behind the numbers

The CFO’s responsibility is to provide wise financial advice for the business to increase revenue for shareholders. Today, the flow of financial information in real time greatly improves the ability of a Director to detect patterns, predict the behavior of strategic variables and define a course of action. Actual results, main indicators (K {Is), help identify potential risks and positively influence timely advice. The dynamism in making informed decisions has become the heart of all finance departments.

The financial planning tools used should be able to help financial leaders shorten the feedback cycle with other members of senior management to allow them to make corrective decisions. Adaptive Insights is a financial solution that manages to meet these requirements. This platform has managed to transform the way in which companies manage their planning and create value in traditional finance processes, with real-time access to information, analysis, and corrections of strategies, are a great competitive advantage.

Avoid data overload: Separating Noise Signals

One of the biggest challenges of this era of communication and instant feedback is the tendency to drown in noise and not be able to recognize the signals until it is too late. You must learn to distinguish signals from noise.

With the arrival of intelligent and analytical solutions, we are now better able to relate external events to internal revenue trends and to be able to isolate more erroneous hypotheses that destroy value. It has become one of the CFO’s most important responsibilities to identify these trends and alert other directors with solutions to address the challenge before it is too late.

Security, Availability and Accuracy

The growing importance of real-time data means that it is vital to protect the accuracy and integrity for a company, of any size, and thus mitigate financial risk. At the same time, it means that CFOs and financial professionals have a growing role in protecting company data.

Today, data risk management is an integral component of every financial audit program. With the huge cost of losing data integrity, it is essential to invest in systems and processes that prevent data failure, rather than paying to clean up the mess later.

Adaptive Insights is a cloud platform that guarantees secure access to information, is available 24 hours a day, 7 days a week, and ensures that the entire work team accesses a single source of information. And it does not require administration by the Technology area.

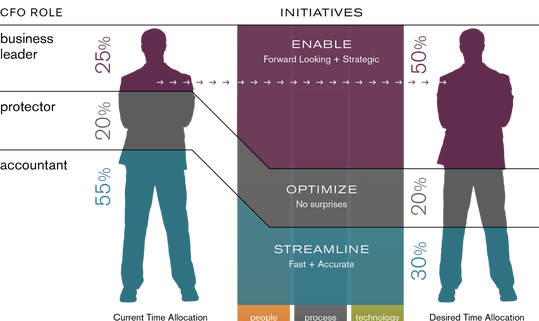

The result: Change the time allocation of the Financial areas: Automate operational tasks to focus on strategic activities.